The IMF’s Executive Board said that the 12-month loan deal with Egypt under the SBA arrangement that ended in June 2021 achieved its primary objective in terms of maintaining the country’s macroeconomic stability.

The IMF announced these revelations in its Ex-Post Evaluation of Egypt’s Exceptional Access under the 2020 Stand-By Arrangement (EPE) report,

The report added that the results were broadly in line with programme objectives, even as exchange rate variability remained limited.

Egypt’s economy remains vulnerable because of the high public debt burden and the large gross financing requirements, which require the authorities to adopt decisive progress on deeper fiscal and structural reforms to boost the country’s economic competitiveness, improve governance, and strengthen its resilience against shocks, which is what will chart the map for the new loan that Egypt requested from the International Monetary Fund (IMF), the fund said on Wednesday.

“While the Egyptian economy has successfully weathered the COVID-19 shock, the external and debt vulnerabilities that existed prior to the crisis remain high. High public debt and large external financing needs leave Egypt vulnerable to shifts in financing conditions,” said the IMF.

In this respect, the IMF estimated Egypt’s debt to GDP ratio at 93 percent by the end of FY2021/2022, which concluded by the end of June.

To cope with the severe impacts of the COVID-19 outbreak, Egypt filed two requests in 2020 to the IMF to secure two loans.

One of them was under the Rapid Finance Instrument (RFI) worth $2.7 billion, which was disbursed over one tranche to provide cash liquidity for the local market.

The other was under the SBA Arrangement and had a total value of $5.2 billion, which was handed to Egypt in two tranches with the aim to help the government implement its second wave of reforms and preserve the gains of the first one.

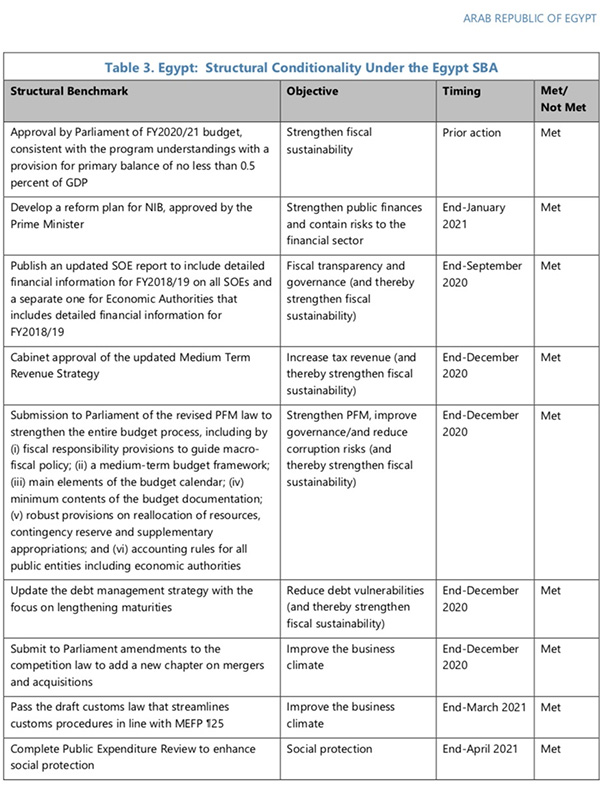

“External and domestic confidence strengthened, and quantitative programme targets were comfortably achieved. Both reviews of the SBA were concluded on time, and all programme conditionality was met. While some of the governance commitments regarding COVID-19 related expenditures have been implemented, others remain outstanding,” the report said.

“The focused structural reform agenda supported by the SBA was fully executed. Going forward, decisive progress on deeper reforms is needed to foster private sector development, improve governance, and reduce the role of the state. Fund policies and procedures for financing under exceptional access were followed,” it added.

Furthermore, it said that policies were eased to accommodate emergency spending on health and social protection along with keeping fiscal sustainability.

“Directors welcomed that all programme conditionality was met and both reviews were completed on time. The directors also observed that a better-than-expected external environment combined with policy implementation under the arrangement strengthened domestic and external confidence,” read the report.

“They concurred that conservative macroeconomic projections, the authorities’ commitment to fiscal discipline, and a well-focused structural reform agenda were important factors for the successful conclusion of the SBA. Directors agreed that policy implementation under the SBA was broadly in line with programme objectives.”

On the exchange rate, the report said that greater exchange rate variability during the SBA could have been entrenched to cope out a build-up of external imbalances and facilitate adjustment to shocks.

The IMF also called on the authorities to meet the governance commitments of COVID-19 related expenditures, adding that the government showed a strong track record of implementation of fund programmes.

It also noted that the SBA loan programme was conducted in a manner consistent with the fund’s policies and procedures and welcomed the stringent application of the Exceptional Access Framework and risk management procedures.

Egypt is currently in discussions with the IMF to secure a fresh loan to address the harsh impacts of the Russian-Ukrainian War, the soaring inflationary wave, and the increase in the cost of energy resources.

If approved, it would be the fourth loan Egypt obtains from the IMF since the implementation of the IMF-backed economic reform programme in 2016, which the fund financed with a loan of $12 billion.

On Tuesday, the IMF maintained its projections for Egypt’s real GDP growth in 2022 at 5.9 percent, while revising it down to 4.8 percent in 2023 owing to the ongoing global economic crisis that severely hit the food and tourism sectors in the country.