Fitch Solutions revised down Egypt’s real GDP growth for the upcoming FY2022/2023 — Which starts on 1 July — to 4.9 percent, down from the 5.5 percent it initially projected.

This makes Fitch the only global financial institution to downgrade Egypt’s growth projections since the outbreak of the Russian-Ukrainian War.

In its monthly updated report on the Middle East and North Africa’s (MENA) outlook, Fitch attributed its revision to the impacts of the Russian-Ukrainian conflict, explaining that it will affect Egypt in terms of the higher commodity prices, disruptions to wheat supply, lower tourist inflows, and increased risk aversion towards emerging markets.

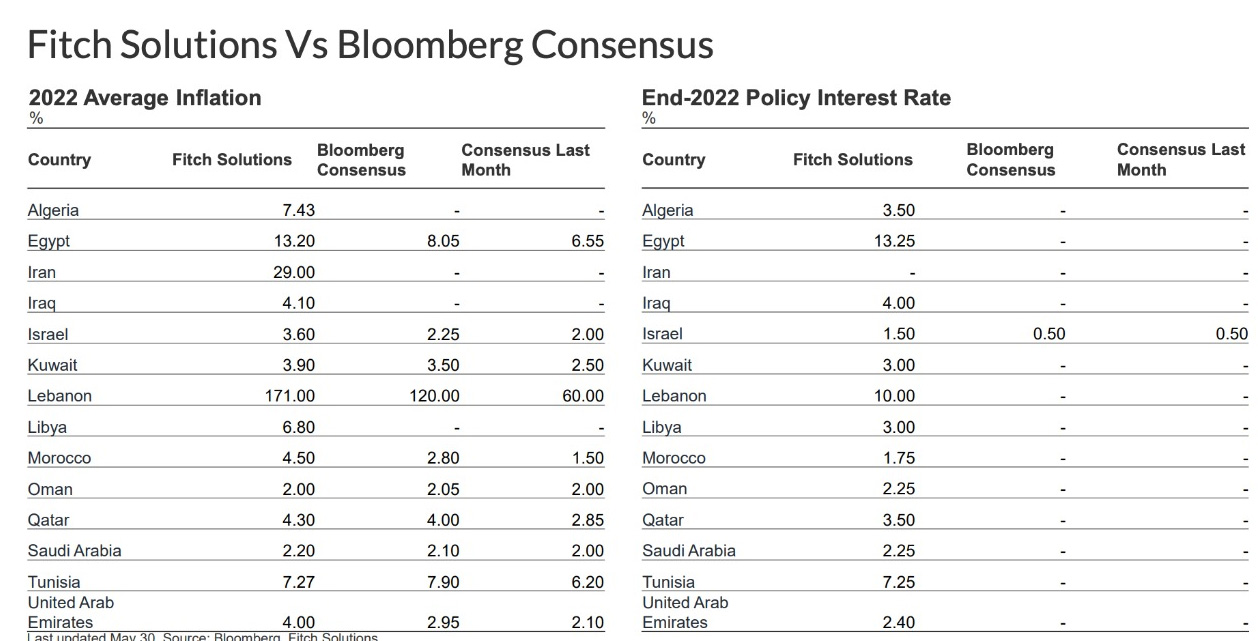

“Soaring inflation and monetary tightening will weigh on private consumption, while a rising subsidy bill and debt servicing costs will force reductions in capital expenditure,” the report further added.

The report also touched upon Egypt’s external position, expecting it to remain weak, as the Ukrainian war fuels the heightened risk aversion towards emerging markets, which will likely make the return of portfolio flows more challenging.

This is despite the anticipated deal that Egypt is brokering with the International Monetary Fund (IMF) and the GCC’s support to address the severe impacts of the war in Ukraine, according to the report.

The UAE, Saudi Arabia, and Qatar have backed the Egyptian economy with $22 billion so far to deal with the ongoing economic challenges.

Also, a number of Emirati firms and the Abu Dhabi Sovereign Wealth Fund (ADQ) announced that they will expand their investments across several sectors in Egypt, mainly real-estate and education.

“Given this backdrop, we believe that authorities will increase their efforts to secure bilateral and multilateral funding while attracting foreign investment to cover the country’s external financing needs,” the report illustrated.

“Worsening economic conditions in Egypt, amid soaring inflation and weaker economic growth, will increase social discontent.”

As a result of the Ukrainian-Russian War, the government lowered its projections for the country’s real GDP growth to 5.5 percent, down from the 5.7 percent it expected previously.

Real GDP growth is projected to hit 6.4 percent by the end of FY2021/22 thanks to the country’s gradual economic recovery from the pandemic, according to the FY2022/23 budget plan.

On a regional level, the report said that North Africa is the most affected region in MENA by the fallout of Russia’s invasion of Ukraine due to the elevated inflation, the rising import and subsidy costs, and evolving risk-off market sentiment towards emerging markets.

“As a result, we expect North Africa’s real GDP growth will decelerate from 5.4 percent in 2021 to 4.4 percent in 2022. While Egypt, Tunisia, and Morocco will see their macroeconomic fundamentals weaken in coming quarters, and elevated hydrocarbon prices following the Russia-Ukraine war will provide temporary respite to Libya and Algeria,” the report expects.

Moreover, all North African economies will have recovered to their 2019 size in real terms by the end of 2022 except for Tunisia — which is projected to recover in 2024 — and Libya, which is not anticipated to recover until 2031, according to the report.