Egypt’s economy has withstood the shocks caused by the outbreak of the coronavirus pandemic in February through the adoption by the government of an extraordinary combination of economic and monetray policies.

These policies ameliorated the negative impact of the pandemic on unemployment and inflation, while securing much needed funds for critical development projects.

As the year comes to a close, the country’s economy survived the toughest test it faced since the launch of the economic reform programme in November 2016.

Macroeconomic indices

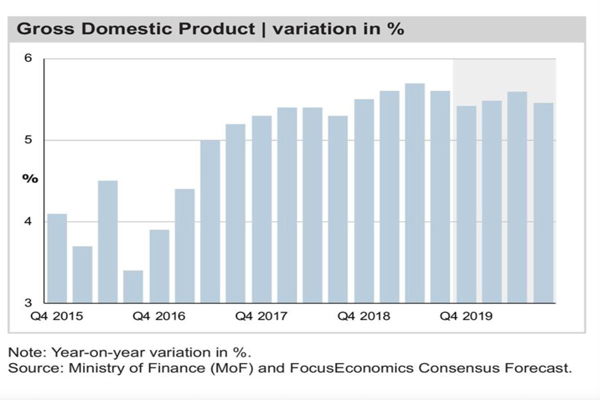

Prior to the outbreak of the coronavirus in Egypt in February, Egypt’s economic growth had recorded 5.6 percent in the first half of FY 2019/2020. However, growth began to decline in the third quarter of FY 2019/2020 to record five percent.

Growth registered 3.8 percent in the first quarter of FY 2020/2021 — July-September — and 3.5 percent in the second quarter of the fiscal year — October-December, according to the Planning and Economic Development Ministry.

Minister of Planning and Economic Development Hala El-Said said in September that growth may further contract to two percent in 2021.

Other macroeconomic indices were also affected by the coronavirus. Unemployment rates, for example, recorded their highest levels in two years in mid-2020, hiking up to 9.6 percent, up from 7.5 percent in FY 2018/2019, according to the Central Agency for Public Mobilisation and Statistics.

Inflation is expected to increase to 7.4 percent, up from 7.2 percent prior to the pandemic.

According to Statista, a German company specialising in market and consumer data, inflation may skyrocket to 8.6 percent in 2021.

Reform buffers

However, while Egypt’s International Monetary Fund- (IMF) backed economic reform programme had a severe impact on Egyptians since it was rolled out in 2016, it has provided bold buffers that enabled Egypt to absorb the economic shock of the pandemic with the least losses.

The government launched several initiatives to support its economic sectors, particularly the hardest hit ones. The target was to curb the economic repercussions of the pandemic and to maintain the gains of the economic reform programme.

Moreover, the government announced in November that the FY 2020/2021 budget — the largest ever in Egypt’s history at EGP 2.2 trillion — was seeing an increase in spending at EGP 1.7 trillion, EGP 138.6 billion more than in FY 2019/2020.

This came in a bid to contain the pandemic’s impact on the state budget. Revenues recorded losses estimated at EGP 220 billion (approximately $14 billion) in the fourth quarter of FY 2019/2020, according to the finance ministry.

Meanwhile, the government raised public investments in FY 2020/2021 to EGP 280.7 billion — an unprecedent occurrence — up by 35 percent in FY 2019/2020 to deal with the economic slowdown amid the COVID-19 crisis.

Further, Egypt has expanded spending on healthcare amid the crisis, allocating EGP 73 billion for the health ministry in FY2019/20, which was doubled in FY2020/21, according to Prime Minister Mostafa Madbouly.

Also, over 1.5 million workers received a three-month allowance — worth EGP 500 disbursed monthly, amounting to a total of over EGP 2.4 billion, the manpower ministry announced in October.

Slashing interest rates

Concerning the monetary policy, the Central Bank of Egypt (CBE) adopted a monetary easing policy, resulting in a slash in key interest rates by four percent (400 bps), the largest cuts introduced since the flotation of the Egyptian pound in November 2016.

The CBE also launched a number of initiatives to support the private sector, small and medium-sized enterprises, tourism, agriculture, and manufacturing sectors.

The CBE provided banks with a EGP 100 billion loan — with a declining annual rate of return of eight percent — to finance private sector manufacturing companies, agricultural production, and processing firms.

The sum also targeted backing export sector corporates whose annual revenues are estimated at EGP 50 million and providing credit facilities to finance the purchase of raw materials and equipment for production lines.

In 2020, the IMF approved two loans for Egypt under the rapid finance instrument worth $2.7 billion disbursed in one tranche, and the stand-by agreement facility with a total of $5.2 billion disbursed in three tranches within a year that ends in June 2021.

Funding development projects

Moreover, Egypt managed to secure $9.8 billion in development financing for its Sustainable Development Goals 2030 in response to the pandemic challenges and to accelerate economic growth.

Although Egypt’s economic growth has contracted owing to the pandemic, international financial and credit rating institutions expected Egypt to be the only country in the North Africa and Middle East (MENA) region to experience positive growth during 2020 and 2021.

The estimates were based on the gains of the economic reform programme and the measures Egypt has adopted to contain the repercussions of the coronavirus.

Growth contracted but outlook positive

The IMF expected Egypt’s real GDP growth, as an oil importer in MENA, to decline to 3.6 percent in 2020, down from 5.6 percent in 2019, and to continue to drop in 2021 to reach 2.8 percent.

The IMF also expected Egypt to be among the fastest 10 growing economies in the world in 2020, and to record the second highest economic growth rate in the world.

The World Bank forecast the country’s real GDP growth to contract to 3.5 percent, down from 5.6 percent in 2019, and to 2.3 percent in 2021, projecting it to bounce back in 2022 to reach 5.8 percent.

Concerning credit ratings institutions, JP Morgan announced that Egypt is the only country in the Middle East and Africa that successfully concluded the annual cycle of reviewing credit ratings and kept the confidence of the three global credit rating institutions — Fitch Ratings, Moody’s and Standard & Poor’s — despite the global and domestic challenges posed by the pandemic.