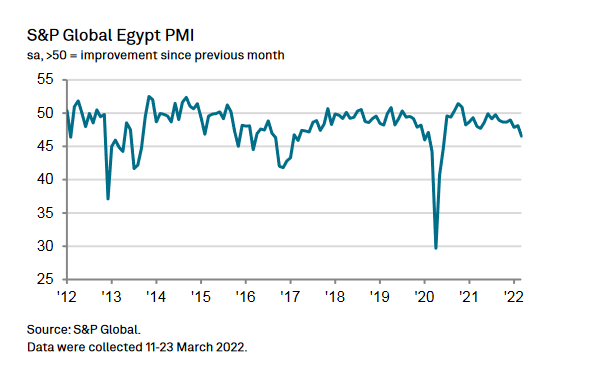

Egypt’s non-oil economy suffered a strong decline in business conditions in March, with its Purchasing Managers’ Index (PMI) falling to 21-month low, a survey showed on Tuesday.

The S&P Global Egypt Purchasing Managers’ Index fell to 46.5 from February’s 48.1, its 16th month below the 50.0 threshold that separates growth from contraction.

The “amplifying of inflationary pressures on energy, food and raw materials amid the Russia-Ukraine war led to sharp decreases in output and new orders.” S&P Global survey read.

Lower business conditions have been affected by intensifying inflationary pressures on energy, food, and raw materials due to the war in Ukraine, resulting in lower output and new orders, according to a press release on Tuesday.

Alongside inflationary pressures amid supply concerns, import costs rose due to a devaluation of the Egyptian pound.

Meanwhile, companies lowered their purchases of inputs at the quickest level in nearly two years, while employment levels retreated for the fifth month in a row.

The Economist at S&P Global, David Owen, said: “The non-oil economy was clearly hit by the effects of the Russia-Ukraine war during March, with firms often seeing clients pull new orders back amid increased prices and economic uncertainty.”

Owen added: “While the 14% devaluation of the Egyptian pound on 21 March may provide some short-term support for the economy, it will also likely accelerate cost pressures.”