Fitch Ratings said on Tuesday that pressures on Egyptian banks’ credit profiles and viability ratings have eased on improvements in the country’s operating environment since end of the third quarter of 2020.

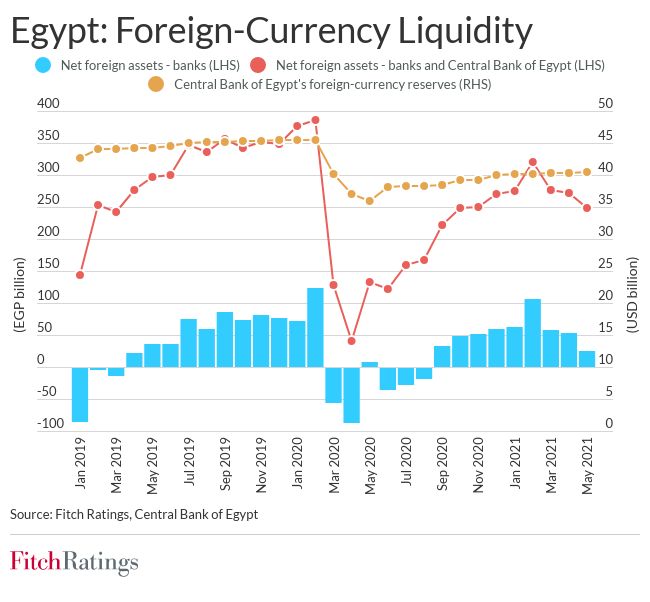

The rating agency has revised its outlook on the Egyptian banking sector’s operating environment to stable from negative in July, largely due to the improvement in foreign-currency (FC) liquidity, which had net foreign assets of $1.7 billion at the end of June 2021.

“We revised our outlook on the Egyptian banking sector’s operating environment to stable from negative in July, largely due to the improvement in foreign-currency (FC) liquidity, which had net foreign assets of USD1.7 billion at end-June 2021. This compares with net foreign liabilities of USD5.3 billion at end-April 2020 after foreign investors sold their holdings of local-currency government securities at the start of the pandemic, causing USD17 billion worth of portfolio outflows.” Fitch said in a statement.

“Egyptian banks’ Issuer Default Ratings that are driven by their Viability Ratings are now on Stable Outlook, reflecting the stable outlook on the operating environment.”

The FC liquidity improved as foreign holdings of Egyptian treasuries rose to $29 billion at the end of May 2021 from $10 billion at the end of June 2020 and the sovereign issued $4.55 billion of Eurobonds between September 2020 and February 2021.

Fitch added that a $5.2 billion IMF Stand-By Arrangement helped to restore investors’ confidence. FC remittances were also resilient in 2020, increasing 10 percent year-on-year to $30 billion.

“The banking sector’s net foreign assets of USD1.7 billion at end-June 2021 were still below pre-pandemic levels (end-February 2020: USD7.3 billion) due to higher foreign liabilities as banks borrowed more from international development finance institutions to support their FC liquidity.”

Fitch explained that the increase in foreign liabilities poses some repayment risks as banks’ debt-servicing capacity could come under renewed pressure from another wave of sell-offs by foreign investors.

However, about 70 percent of the sector’s external debt is long-term and banks hold adequate stocks of FC liquid assets against their short-term FC liabilities, the rating agency noted.

“Some banks have started to pre-pay their FC term loans given their comfortable liquidity buffers and weak demand for FC loans, with lending geared towards working capital financing rather than capex.

Fitch said it expect banks’ FC liquidity in 2021-2022 to be supported by Egypt’s expected stable current account deficit, higher FX reserves, and a gradual pick-up in tourism.